Recent news surveys, such as confirmation of the $ 500 million micro-strategy purchase in the near future, and data from bitcoin inflows and outflows from digital currency exchanges, show that whales and micro-investors are collecting bitcoins. . Could this be a signal for Bitcoin to reach its price floor? In the continuation of this article, be with trends online exchange to examine this important question.

Everything you need to know about Shiba Inu coin

According to the Daily Hoodle, Will Woo, one of the leading analysts in the digital currency market, who has been closely monitoring the flow of bitcoins in and out of exchanges in recent days, believes that whale activity is a sign that bitcoins are on the price floor. Is.

Can I mine Bitcoin on my laptop?

In recent months, along with the decline in the price of other digital currencies, bitcoin purchases have undergone a relatively long correction. With prices falling below $ 32,000 for the short term in recent days, many market participants are waiting to see if Bitcoin can return. Undoubtedly, moving wallets and collecting bitcoins can be a good sign for the king of digital currencies. Next, by looking at the data that Will Woo has referred to, we can better decide whether Bitcoin will reach the price floor and start moving upwards.

How many bitcoins are left to mine 2021?

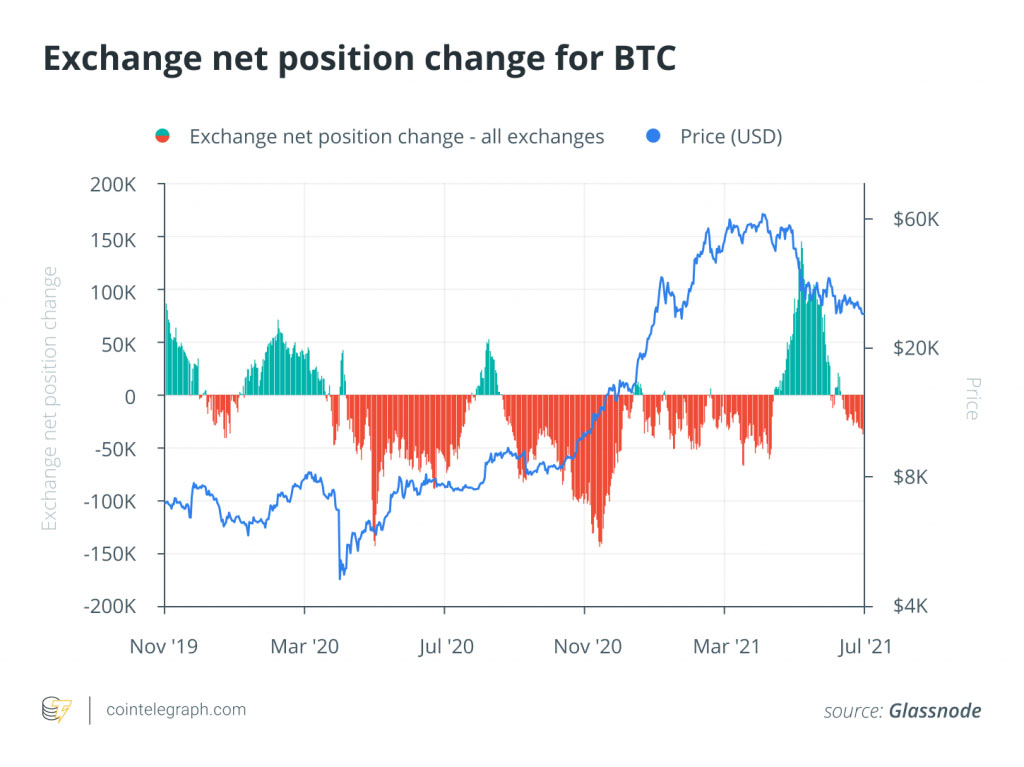

“Despite declining price fluctuations, bitcoins in exchange offices are withdrawing rapidly,” Wil Woo said in a recent speech. “Recent measurements show that withdrawals are at the highest level relative to deposits and whales are accumulating.”

Bitcoin inflows and outflows in exchanges

Transferring bitcoins in an exchange and transferring them to cold wallets can cause a supply shock. Supply shocks occur when the supply of an asset sharply decreases or increases. By transferring bitcoins to cold wallets, we can predict a sharp decline in bitcoin supply. In this case, the demand in the market will be continuously more than the market inventory.

Will Woo also mentioned in his speech that the ratio of bitcoins in digital currency exchanges to the total supply has been reversed. Given that the price also follows this change, we can say that the supply shock has formed to some extent.

More importantly, the last time this happened (supply shock) was shortly before the price jump in October 2020. When Bitcoin started its strong bullish market.

Bitcoin supply shock rate

Will Wu believes that the fundamental factors are so powerful that he does not want to choose a short position. “I think if someone shortens this market, they will lose if they have enough time,” he said. “In this game, we just have to wait until the fundamental factors dominate the market.”

Bitcoin is currently well supported after hitting a low of $ 32,000 and has been able to push back to the $ 34,000 limit. Crossing the $ 35,000 resistance could be a positive sign to predict. Will Woo be. Of course, the timing of the market change is not yet clear and should not be rushed, however, according to data provided by Wil Woo, $ 32,000 can be considered as the bitcoin price floor.

How long will the market be down?

Investigate the up and down signals of bitcoin

Is the downturn over? Will we see an upward comeback in the market? It is not clear where the market is heading at this time, but we can make some predictions about the future by looking at the downtrends in Bitcoin. So stay tuned to trends until the end of this article.

According to the Coin Telegraph, it has been about three months since Bitcoin reached the $ 65,000 mark and reached its all-time record price. In the last two months, Bitcoin has been trading in the range of $ 30,000 to $ 40,000, which is on average 54% lower than its historical price.

The downturn occurred at a time when many analysts were predicting exactly the opposite. Analysts had expected the bitcoin market to reach a record high over the past few months, and some expected the price to reach more than $ 100,000 this year.

So why is the market in the current situation? Is the current recession just a correction in an uptrend, or is the digital currency market experiencing another downturn after 2018?

Signs of a bullish market

The historical trend of bitcoin price changes is logically correlated with the Hawing cycle. Historically the highest bitcoin prices have already been recorded 12 to 18 months after Howing. PlanB, a well-known analyst and creator of the Bitcoin S2F model, is a proponent of this hypothesis. He also believes that the asset accumulation model (S2FX) predicts more uptrends for Bitcoin. He has repeatedly pointed out that the market has faced such declines before the start of previous uptrends.

Asset-to-Flow (S2FX) model is a more advanced version of the flow-to-flow (S2F) model. In addition to bitcoin, this model can also predict the future currency of other assets. So far, the prices predicted by this model have been very accurate. Therefore, its predictions of an increase in the price of Bitcoin can be trusted.

In addition, in-chain data also confirms the hypothesis of an increase in the price of bitcoin. Igneus Terrenus, director of public relations at Bybit Exchange, said short-term investors were the main reason for the fall in bitcoin prices from a recent high.

Igneus Terrenus, director of public relations at Bybit Exchange, said short-term investors were the main reason for the fall in bitcoin prices from a recent high.

Wider bullish indicators and indicators in the market

Project funding, or the amount of funding raised by new digital currency projects, is another important indicator of measuring emotions in the market. In 2021, cryptocurrency-related startups have been able to perform exceptionally well in attracting funding. According to Kevin Telegraph, the 2.6 billion budget collected by crypto startups in the first three months of 2021 is more than the total budget for 2020.

The recession, which began in April 1400, did not seem to have a negative effect on the appetites of venture capitalists. In late May (early June), Circle, the supplier of StableCoin USDC, raised $ 440 million. Shortly afterwards, Galaxy Digital, led by Mike Novogratz, launched a $ 100 million digital currency investment fund.

In mid-June (late June), Bloomberg reported that the value of venture capital investments exceeded $ 17 billion in the digital currency market. Even Block.one recently announced that it has invested $ 10 billion in launching its new exchange. Suffice it to say that the performance of digital currencies in the second quarter of this year has not affected the growth of venture capital investments.

In addition, there are big issues in the market that need to be considered. Amid skepticism about the state of the world economy, some, including Robert Kiyosaki, author of The Rich Dad, The Bipolite Father, have predicted a stock market crash. Kiyosaki has encouraged his fans to store gold and bitcoins. This can be seen as a sign of greater correlation between Bitcoin and the stock market. But could a massive stock market crash mean investors move to the bitcoin market as a safe haven?

Another noteworthy point is the Taproot Bitcoin update, which is scheduled to launch in November. This is the first bitcoin network upgrade since the 2017 Segwit update. It is worth mentioning that the Segwit update was accompanied by the recording of a new historical peak of $ 20,000 in December 2017 (Azar 96). Understanding whether history repeats itself and whether there is a correlation between network upgrades and price is hard work, yet it is worth remembering.

Monitoring devices, the main factors of market downturn

Oversight monitoring devices have been the main driving force behind the downturn in recent months. Chinese government rules to prevent bitcoin mining are the most important factors in creating widespread uncertainty in the market. Many large bitcoin mining companies have ceased operations. Some have moved temporarily and some permanently from China to new countries. These migrations have undoubtedly put a significant cost on miners. This made the difficulty of extracting bitcoins the biggest drop in its history.

Other countries are also legislating and scrutinizing digital currencies. The Indian government has recently taken a calmer stance on digital currencies, but may re-impose bans.

The UK Treasury recently launched a wave against Bainance, ordering the exchange to suspend all legislative activity in the country. Many digital currency companies are now licensed in the UK, but Bainance UK users are faced with blocking the possibility of depositing money into their accounts by UK banks.

In general, Binance has come under pressure from regulators around the world for a variety of reasons. One country after another has banned the exchange from operating. Becomes.

Organizational analysts have already made disappointing forecasts for the price of bitcoin. JPMorgan recently warned that the bitcoin market situation seems volatile in the medium term. These developments have not been as effective as the ban on mining in China, but they have certainly not helped boost investor confidence.

Is it possible to change the market trend?

According to the Kevin Telegraph, most of the benchmarks that indicate a bullish market trend are still halfway through. Now, can we say that there is enough evidence to reverse the current downtrend?

All the cases have been considered and it is not surprising at all, now it is too early to give a definite answer to this question. On the one hand, the controversy of regulators and the significant decrease in trading volume indicate a lack of widespread interest and interaction in the market, and on the other hand, some intra-chain metrics and indicators show signs of market sentiment that continues to rise a few months ago.

Finally, regulatory action continues to disrupt the market, and price forecasting models and venture capital investments in digital currency projects do not necessarily address traders’ concerns. If more widespread pressure is added to these, the uptrend will probably never resume.

The fact that the price has been maintained above $ 30,000 so far, although it may be the biggest test for the miners’ activity, is a testament to the uptrend in the market. If the pressure of the monitoring devices continues to decrease, there is a good chance that the upward segment of the market will implement its projected plan.

23 key points for bedroom layout and creating a relaxing atmosphere

Biography of Shaun White, the first snowboarder to win three Olympic gold medals