Technical analysis is one of the most important and attractive tools for analyzing the digital currency market and the stock market. In order to be able to invest better, more efficiently and more accurately, investors are trying to use technical tools to be able to predict the digital currency market and the stock market in a timely and optimal manner. In order to be profitable, you have to constantly analyze and assess the situation.

In this regard, the head and shoulders pattern is one of the most important patterns in technical analysis that helps you to predict the trend of market price change. But what is the head and shoulder pattern and how should it be used? In this article, we will examine the head and shoulder pattern in a special way and teach 0 to 100 how to recognize the head and shoulder pattern so that you can enter the market in the best possible time; You get the most out of it by recognizing patterns in time.

What is the pattern of digital currency head and shoulders?

The Head And Shoulders pattern is a popular pattern for investors, which in technical analysis makes it easy to predict the trend of price change. Fortunately, the head and shoulder pattern filter is one of the simplest patterns and is usually recognizable to investors.

The head and shoulders pattern is a downtrend and we will continue to see a fall in prices and a downtrend in the stock market and digital currencies. In the digital currency exchange application, you can see the digital currency head and shoulder pattern diagram.

How is the head and shoulder pattern formed?

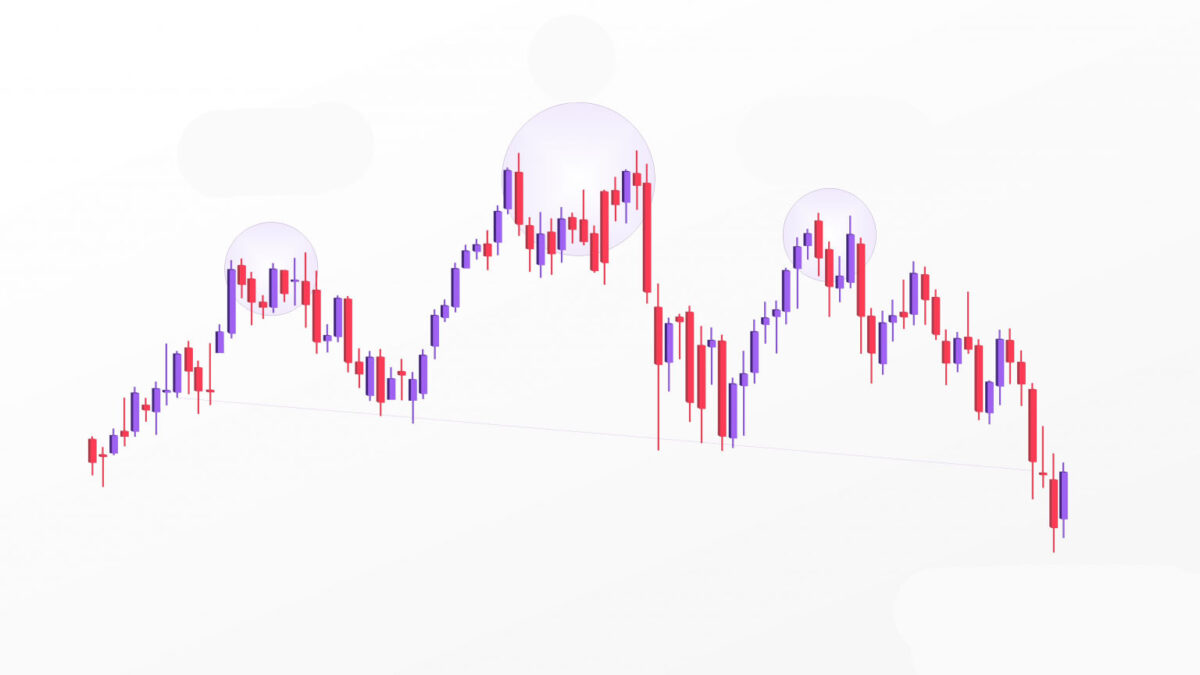

The head and shoulders pattern is actually a return pattern and we should wait for the price to return. As the name implies, the head and shoulder pattern consists of a peak and two shoulders, and occurs when the stock price has reached its ceiling. In this case, the price will soon return to the bottom of its last price. The price then rises above its previous level and then approaches the first peak and takes a downward trend.

Timely identification of patterns helps you to better and more efficiently manage your capital; Especially if the digital currency you have invested in, such as Bitcoin, Atrium Classic , Bitcoin Cash, Bainance, and… has a high price.

Note that the head and shoulder pattern is usually not fully formed and there may be other movements and changes between the shoulder and the head. It should be noted that the trend behind the head and shoulder pattern is ascending. After identifying the pattern, pay attention to the continuation of the process so that your analysis does not make mistakes.

What is a reverse head and shoulder pattern filter?

The reverse head and shoulder pattern also includes the left shoulder, head and right shoulder. On the left shoulder we will see the price decrease and then an inverted triangle like a valley will form and then the price will increase. At the head, prices will fall again and there will be a fall below the first valley. On the right shoulder, prices will rise and prices will continue to fall and a new valley will be formed.

If you are trading digital currencies such as bitcoins, which are highly valued in rials, it is best to use a bitcoin calculator to calculate the value of profit and loss and possible prices, with accurate and fast calculations according to patterns.

Note that reverse head and shoulder formation is not usually as complete as the head and shoulder pattern, and there may be other movements between the left and right shoulders and even in the head. It should be noted that after the reverse pattern of the head and shoulders, the price trend is downward. For this reason, it is necessary that when you identify the type of pattern, you also pay attention to its continuation process so that you can take your login and exit actions as soon as possible.

Inverted head and shoulder pattern on the ceiling

The upside-down pattern on the ceiling usually occurs at the end of the uptrend and the market continues to decline. As the name implies, there are three peaks in the head and shoulder pattern of the roof, the middle of which is higher. Once you have identified the pattern of the roof and shoulders of the roof, you should wait for the neckline to break.

Given that patterns are usually not fully formed; You need to practice in order to be able to quickly identify patterns;

But if there is a rapid fall and you miss the opportunity, you have another chance. Then wait for the return line to the neck. Future digital currencies such as Dodge Quinn and Atrium may have many patterns because of the large number of users they have. Identifying patterns in a timely manner will have a direct impact on your profits and losses.

Twin head and shoulder pattern; The most profitable model

One of the most lucrative patterns is the twin head and shoulder pattern. Identifying this pattern can be very rewarding. In the technical analysis of the twin head and shoulder pattern, note that it usually forms at the end of a downtrend and is a sign that the price is rising. The twin head and shoulder pattern is similar to w. The peak is in the middle of the neckline, and after it breaks, prices are expected to rise as much as the neckline.

If the patterns are formed in the twin head and shoulder pattern for a longer period of time, they will be more reliable and will have high credibility. The time interval between two valleys is usually 2 to 6 weeks. That’s why you should check your digital currency chart for at least 1 month. Note that the trading volume in the first valley is usually higher and the players are looking to buy and enter the stock.

How to use the head and shoulder pattern?

To use the head and shoulder pattern, you must first wait until the pattern process is complete. Because a pattern may not be completed or part of it; For this reason, we have to wait until the template is completed. Note that no trade should be made according to the neckline pattern. When the pattern is complete, you have to wait for the price to go lower than the right shoulder.

Then after the template is complete, you can do your trading. You need to plan for each type of transaction and record your profit and loss. Any unplanned transaction may cause you to incur a loss. While planning, keep in mind that you should note and monitor any variables that may fluctuate your profits and losses.

If you want to make the most of the head and shoulders pattern, you have to make a logical decision and set your entry point after the price goes back and you reach the neckline. In fact, the return is like V. This is the best time to enter the market when prices fall and reach the bottom of the price and rise again to get closer to the neckline. This method, although cautious, is very logical and can enter the digital currency market with more confidence.

Why is the head-to-shoulder pattern efficient in digital currency trading?

The patterns described in this article are not without flaws, and the patterns are not always effective and useful, and may change as the patterns continue, or you may mistakenly identify a pattern. However, the head and shoulders pattern has features that can be used effectively in the digital currency market.

It is quite logical that when prices approach the ceiling, that is, the same part of the head, sellers enter the market to sell their currency, and in this case, the buying pressure is reduced. Also in the neckline, traders who have suffered in the process of rising and falling of the market are leaving the market and the price trend is moving towards the target. Determining the extent of the loss is very useful at any stage of head and shoulder pattern analysis.

In fact, determining the extent of the damage above the right shoulder can make perfect sense; Because the right shoulder is at a lower height than the peak, ie the head, and the right shoulder will not be broken until the upward trend. For these reasons, it can be said that the head and shoulder pattern is efficient, useful and practical, and with timely identification, it can be used to its advantage.

In this article, we have fully explained the question of what is the head and shoulder pattern and how to use it. In fact, the head and shoulders pattern creates an opportunity that, with timely detection, can enter the market at the best possible time and make a high profit. The head and neck pattern consists of three peaks, the middle of which has a higher height and prices will continue to decline.